Volkswagen Foundation - European Challenges Grant

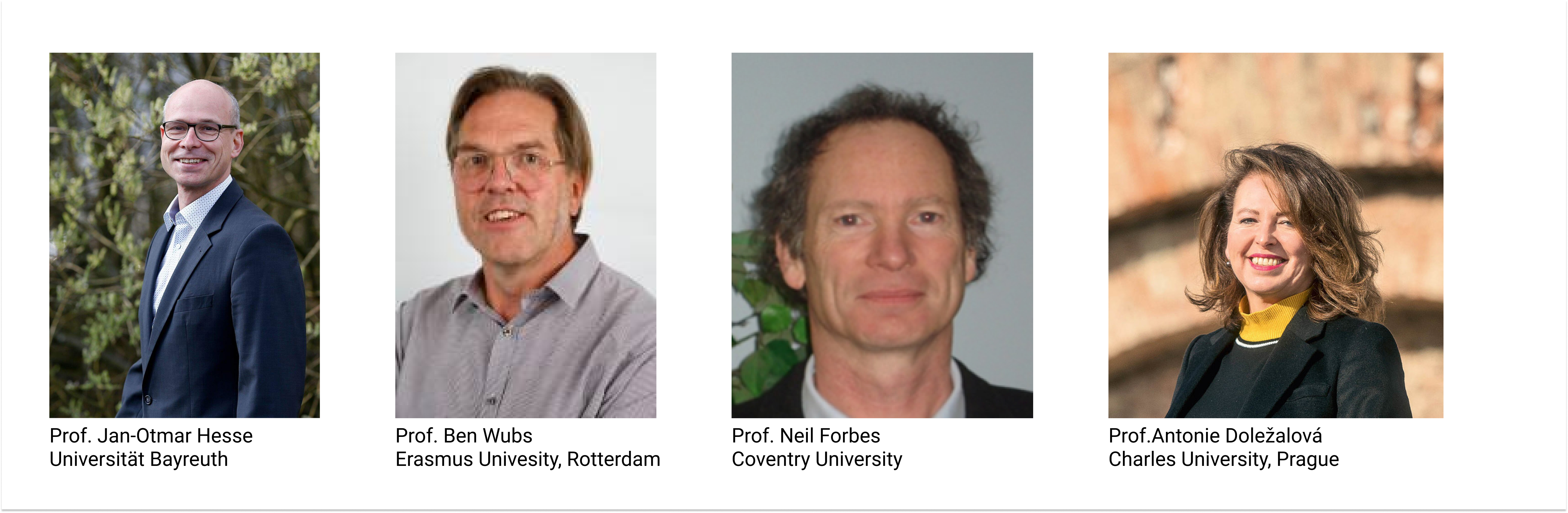

The Department of Economic and Social History has been awarded major grant from the Volkswagen Foundation. From April 2022 to March 2026, the Department will host the international research project "Historical Tensions between International Business and National Taxation: A Challenge for Europe today" that is part of the Foundation's "European Challenges" program. The project is designed as an international cooperation between four universities from four different countries and reknowned researchers: Prof. Antonie Doležalová (Charles University in Prague/Czech Republic); Prof. Neil Forbes (Coventry University, UK); Prof. Ben Wubs (Erasmus University in Rotterdam/Netherlands) and Prof. Jan-Otmar Hesse (Bayreuth University).

As one of the most important challenges for European nations – especially in the aftermath of the COVID-19 pandemic – is to secure sufficient tax revenues in the context of free capital movements. The taxation of MNE in particular poses a great challenge for nation states as well as for Europe as a whole. The European Union is aware of this problem and has recently set up new institutions to monitor MNE tax behaviour. Yet, politicians as well as scholars face the central problem of absent data, which is the main reason for the lack of research on this phenomenon. Quantification and statistical analysis is difficult with, by definition, obscured data. Since sharing of MNE tax reports began only in 2016 (and banks since 2014) we know little about the evolution of MNE’s tax strategies and tax management. In the absence of reliable data, only historical research can fill the gap. After all, the tension between national taxation and international business is not a new phenomenon. It did not arise from the EU’s organisational structure; rather, it has helped to shape Europe’s economic and business history since the 19th century. As business and economic historians, the aim is to analyse the historical dynamic of the conflict of interest between nation states and MNE in all its complexity. The methodological strategy for this research is to analyse the problem of corporate taxation and tax avoidance not on a macro-level of state statistics and finances, but to break the topic down into case studies.

The research team will explore the history of the taxation of Multinational Enterprises (MNE) in Europe on the basis of historical research on four case studies: ARBED; BP; Skoda and Unilever. All four corporations operate production facilities in more than one country. They have all entertained especially close relations to the governments in their home country, because of their social networks but also because of their pure size and their economic power. In all cases, the corporate archives are accessible and state archives hold additional accessible source material. Our research strategy includes archival research, oral history and the comparative analysis of the relationships between the selected MNE and states, with five, major exogenous ruptures serving as an axis of comparison: World War I, 1930s Great Depression, World War II, the erection of the Iron Curtain and its fall. Political ruptures are times of readjustment of tax management regimes and thereby serve as excellent historical experiments to look for common transformations over all cases.

Our project will provide policy-makers with a unique insight into the long-term history of conflict and cooperation between MNE and nation states on the issue of corporate taxation. It will highlight the complexity of multi-layered interaction between states and MNE and the long historical path-dependence of MNE and their global network of specialists. Policy-makers will be informed, with respect to specific historical contexts, on the effectiveness of different measures and policies designed to balance the conflict of interest. We are convinced that the long-term evolution of these institutional structures of interaction is responsible for the continuing success of MNE tax strategies and that the historical background to this European Challenge needs to be understood if policy action is to succeed.

You may also find further information contained in the Volkswagen database here